While US/China trade tensions dominated market sentiment this week after the US said it was considering blacklisting up to five Chinese surveillance firms, there were a couple of positive (albeit) minor developments: the US temporarily eased some of the planned Huawei trade curbs; and China’s ambassador to the US, Cui Tiankai, said that China is ready to continue talks and is committed to forging a new trade deal.

Week ending 24th May 2019.

28th May 2019

However, given Donald Trump appears happy with the current impasse, we should expect the current trade friction to continue for many more months, if not years.

Against that backdrop, we will continue to watch economic data announcements very closely (as this adds to the economic outlook risks – and thus more reasons for the current loose monetary policy and economic stimulus to continue).

Wednesday’s (22 May 2019) minutes from the last Fed monetary policy meeting (held on 1 May 2019) were slightly disappointing. They showed that policymakers thought their patient approach to US interest rate changes would remain “appropriate for some time” and reiterated their view that the recent weakness in CPI inflation is temporary.

While the minutes were mildly hawkish, we still believe that US interest rates have peaked and that the Fed will start cutting US interest rates in the not too distant future, given soft CPI inflation readings coupled with the increase in trade tensions since the Fed’s last meeting.

Furthermore, James Bullard, the St. Louis Fed President, told Bloomberg Television this week that the Fed may have “overdone it” when it increased interest rates last December!

Likewise, this week’s weaker-than-expected UK inflation reading (core CPI was unchanged at 1.8%) continues to undermine the BoE’s insistence that UK interest rates need to be higher.

In the UK, Brexit took centre stage – not because of the European elections or milkshake throwing, but because of Theresa May’s ‘new’ Brexit deal proposal (which immediately flopped) and her subsequent resignation announcement this morning (Friday 24 May 2019).

While the outcome of the European elections won’t be known until Sunday night (26 May 2019), they are fairly easy to predict and the only election that now counts is the one for next Tory leader!

As such, the odds of a no-deal Brexit have risen, given the next leader will need the support of Conservative Party members – and given the likely success of Nigel Farage’s Brexit Party, the Tories are unlikely to appoint a moderate leader. This suggests that Boris Johnson or another hard-Brexit candidate, such as Dominic Raab, are most likely to succeed Theresa May.

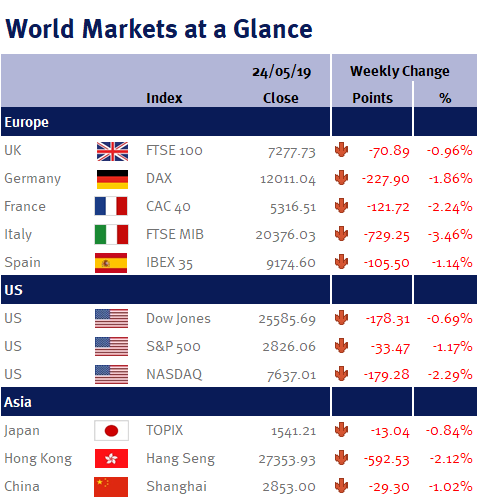

Although the FTSE-100 fell just under 1%, it was supported by a slight weakening in the pound (which fell from $1.2731 to $1.2714) – a weaker pound is good for the FTSE-100, as it boosts returns for exporters and the value of overseas earnings.

However, it was India’s BSE Sensex 30 that was one of the best performing equity markets over the week as Narendra Modi was re-elected as Prime Minster.

This coming week we have the Fed’s preferred inflation gauge, the PCE, and the second reading of US Q1 GDP.

Investment Management Team

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.