Week ending 10th August 2018.

13th August 2018

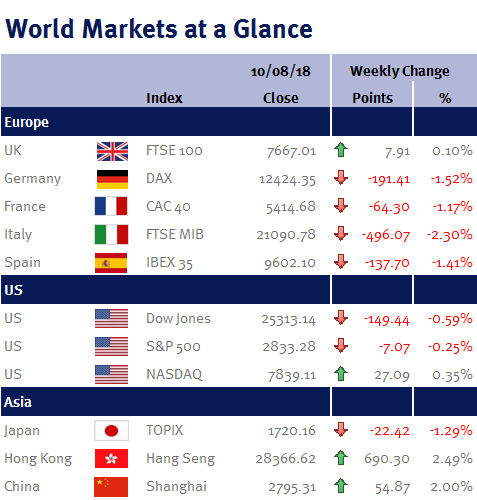

It could be argued that this week has been one of the quietest weeks in terms of volume of economic news that we have seen in 2018… that being said, there has been a handful of influencing factors and data sets that have governed markets.

With the above currency fluctuations in mind, the Russian Ruble depreciated significantly on Thursday following a somewhat delayed set of sanctions imposed by the US in response to the Novichok nerve-agent attack in Salisbury (UK) in March of this year. Whilst it does appear strange that these sanctions come in the wake of US President Donald Trump’s pursuit of improved relations with Putin’s Russia, it is not Trump who moved for these sanctions as Congress, whilst controlled by the Republican Party, has limited Trump’s power to ease sanctions on his own.

Elsewhere we saw Emerging Markets, European markets and their currencies fall today (Friday) off the back of what appears to be a fear of contagion from the crisis in Turkey, and concern that a slide in the Turkish Lira will spill over into European banks. Following the Human Rights sanctions imposed by the US on Turkish ministers last week, coupled with increasing Turkish inflation levels and concern of a financial crisis in the country, the economy seems in disarray. However, whilst we would not be so bold as to say we anticipated specifics, the volatility apparent in the Emerging Market and European asset classes caused by the ‘noise’ in Turkey is just an example of how, when coupled with low volumes traded in the typically quiet summer period, it can cause fluctuations in wider markets. However, whilst the summer period will likely be littered with noise, this can compress market valuations making them look incredibly good value for when volumes re-enter the market at the end of summer (or come the US mid-term elections in November at the latest).

There was a handful of economic data out this week which showed that fundamentals in core markets remain robust. Monday saw Eurozone investor confidence beat expectations, coming in at 14.7 (1.3 points ahead of expectation). China released its trade data on Wednesday with both imports and exports beating expectations. This was supported by strong inflation (CPI) data released on Thursday and increased Chinese foreign reserve levels ($3.1 trillion) released today (Friday), rebuffing sentiment that suggested trade frictions with the US would compress trade through the summer months.

As an aside, Thursday saw the US Vice President, Mike Pence, announce a 5 year, $8 billion programme to launch a US space force as a further arm of their military… however, before thoughts of Captain Kirk battling Klingons in deep space come to mind, the programme is ‘deflatingly’ a further extension to current measures designed to protect satellites, defend from land to air attacks, and to garner intelligence.

Jonathan Wiseman, Investment Management Expert*

*Jonathan Wiseman is a Chartered Wealth Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.