Don’t ditch the LISA.

10th August 2018

The Treasury Committee has called upon the Government to abolish the Lifetime ISA (LISA) stating that it has received strong criticism over its ‘complexity, its perverse incentives, its lack of complementarity with the pensions saving landscape and its apparent lack of popularity with the industry and pension savers’.

Jonathan Watts-Lay, Director, WEALTH at work, comments; “Instead of ditching the LISA completely, thought should be given to making it the key vehicle to help individuals buy their first home.”

He adds; “The LISA is an ideal option for those saving for a deposit on their first home, due to the guaranteed bonus. But many people don’t realise that saving into a LISA can actually help them to save for a deposit faster than using a savings account, and that by getting into the savings habit, it may also actually increase their pension pot.”

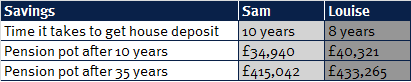

To help with this, WEALTH at work has illustrated how this could work in practice in the example below.

Example:

The individuals in the example below are both age 25 and wanting to save for their first home. They both want to focus on saving for their home, whilst still saving something into their pension.

The calculations assume that both are earning £26,500 p.a., with an annual salary increase of 2.5%, and are aiming to save a 10% deposit to buy a house worth £194,224. The calculations also assume saving rates returns of 0.5% for 10 years, investment returns of 5%, a 9% pension contribution (3% employee contribution with 6% employer contribution with non-salary sacrifice).

Sam – chooses to save £2,000 a year into his savings account at 0.5% interest. It takes 10 years for Sam to save his £20k deposit (£20,558). Meanwhile he is also saving 9% through auto enrolment into his pension each year. In 10 years, his pension will grow to £34,940. Once he has saved his deposit, if he starts saving the £2,000 into his pension instead, based on the assumptions outlined above, he would have £415,042 in his pension by age 60.

Louise – chooses to save £2,000 a year into her LISA. With the annual £500 government contribution added into the LISA, and 0.5% interest, it takes only 8 years for Louise to save her £20k deposit (£20,455k). This is two years less than Sam. Meanwhile she is also saving 9% through auto enrolment into her pension each year. Following her house-buy, she then starts saving the £2,000 she was saving into her LISA, into her pension instead. This amounts to an extra £5,381 in her pension by year 10 in just 2 years.

If Louise continues to save like this until she is age 60, she will have an estimated pension pot of £433,265. This is £18,223 more than Sam because she started with a LISA initially.

These figures are highlighted in the table below;

By using the LISA, Louise gets the house 2 years earlier and gets a bigger pension pot. If individuals also find themselves paying less on their mortgage than what they were when renting property, this could then free up even more money up to go into the pension, resulting in even more in their pension pot.

Watts-Lay comments; “We can see from these figures that whilst Sam and Louise have made exactly the same contributions overall, Louise has the double benefit of getting her first home quicker whilst also ending up with a bigger pension but at no extra cost. The LISA is a great way to help young people to save up the deposit for their first home, and hopefully by getting into the habit of saving, it could also increase their pension pot.”

He adds; “More support is needed in the workplace in terms of financial education and guidance to help people to understand their workplace benefits and savings. Individuals should speak to their employer to see what support is available.”

The latest news is brought to you by WEALTH at work, a leading financial wellbeing and retirement specialist. WEALTH at work and my wealth are trading names of Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.