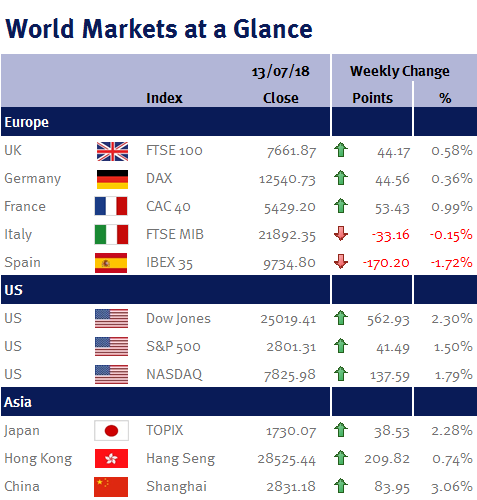

Week ending 13th July 2018.

16th July 2018

While UK political chaos and Brexit uncertainty stole the show this week, it was Donald Trump that moved equity markets.

Global equity markets had a positive glow at the start of the week thanks to a lull in the trade war coupled with a continuation of positive economic data – unfortunately, markets hit a speed bump mid-week after Donald Trump’s administration’s raised the stakes of a trade war by listing an additional $200 billion worth of Chinese goods to potentially hit with US tariffs.

Thankfully, equities recovered much of this weakness after China held off from immediately retaliating (suggesting that China wants to ease tensions and negotiate a compromise agreement), coupled with a buoyant US earnings season. Of the 28 companies in the S&P 500 that have reported, 23 have beaten expectations and in aggregate, earnings are 13.33% higher than the same quarter last year.

In the UK, the pound took a hit after Boris Johnson’s resignation put Theresa May’s Brexit compromise (and her political future) in doubt – although what is bad for sterling is good for the FTSE 100, as it boosts returns for exporters and overseas earnings!

The Office for National Statistics in its first publication of rolling monthly growth figures said that the UK economy grew 0.2% in the three months to the end of May – with output gaining 0.3% in May alone. Additionally, a report from Barclaycard showed household spending rose in June at the fastest annual pace in more than a year (no doubt helped by the excellent weather).

This week, in addition to the Helsinki Summit between Donald Trump and Vladimir Putin, the Fed Chair, Jerome Powell, will testify before Congress. Data wise we have UK unemployment data, wage growth, retail sales and CPI; US retail sales and industrial production; Chinese GDP and retail sales; and Japanese CPI.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.