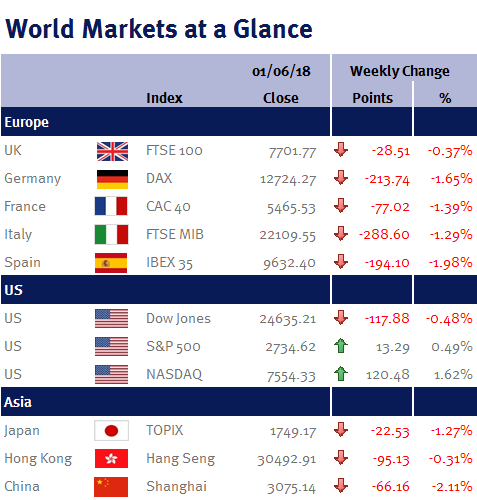

Week ending 1st June 2018.

4th June 2018

This has been one dizzying week!

We should have had a positive opening for equity markets given the news over the weekend that the US/North Korea summit was likely to get back on track, coupled with an announcement from Saudi Arabia and Russia that they were discussing increasing their oil output after the oil price hit a four-year high.

Despite news that the US will impose duties on steel and aluminium from the EU, Canada and Mexico, calm was restored and equity markets managed to recover much of their early losses after a last-minute compromise in Italy avoided a snap election (which would have probably been used as a de facto referendum on the euro and EU membership), while in Spain the transition from Mariano Rajoym to Pedro Sánchez ended-up relatively painless as he committed to adhere to the 2018 Budget.

Economic data also boosted sentiment.

The Fed’s Beige Book showed that the US economy wasn’t showing signs of overheating, as expansion was “moderate” in April and May. Furthermore, annualised US GDP growth of 2.2% in Q1 was slightly lower than previously estimated (2.3%), while US core PCE (the Fed’s preferred inflation measure) slipped to 1.8% from 1.9%. And although today’s (Friday 1 June 2018) US employment data showed payrolls increased by 223,000, April’s data was revised down to 159,000. Average hourly earnings rose 2.7% from a year earlier, while the unemployment rate fell to 3.8%.

While this reinforces my expectations for a US interest rate increase at the next Fed meeting on 12-13 June 2018, it doesn’t suggest to me that the Fed is likely to accelerate their pace of interest rate increases from their previous stated path of three in 2018. In fact, Lael Brainard, a Fed policymaker, yesterday (Thursday 31 May 2018) confirmed that a gradual pace of interest rate increases continues to be “the appropriate path” for the US economy.

Although eurozone inflation jumped to 1.9% from 1.2% in April, this merely highlights the part that the recent jump in oil prices is playing in the higher headline readings across the globe as the eurozone’s core inflation rate (which excludes volatile items such as food and energy and is seen as a signal of where headline inflation will head) came in at just 1.1%.

This coming week we have PMI data from the US, UK, eurozone, China and Japan. We also have eurozone retail sales and Chinese trade and foreign reserves data.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.