Week ending 20th April 2018.

23rd April 2018

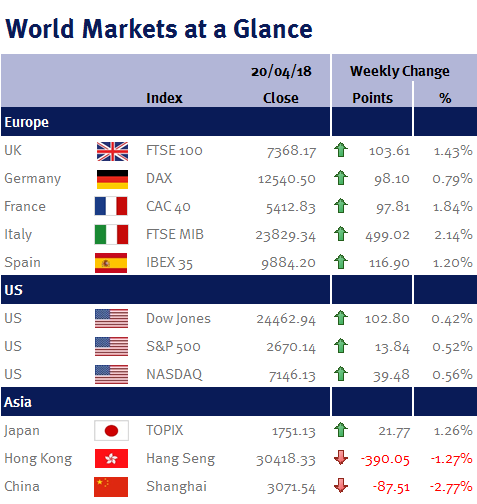

Global equity markets rose this week as concerns over geopolitics subsided due to no reprisal from Russia for the missile strikes on Syrian military bases by the US, UK and France last weekend. Russia and the US do appear to want to improve relations and avoid escalations, as both nations reportedly cancelled additional trade sanctions earlier this week.

Casting further doubt on the outlook for UK interest rates was more data from the ONS on Thursday, showing retail sales fell 0.5% in March as poor weather deterred shoppers and weighed heavily on the high street (adding to the gloom, Debenhams issued a profits warning on Thursday). Mark Carney, the governor of the Bank of England, highlighted the recent mixed data this week and said he didn’t want to be “too focused on the precise timing” of an interest rate hike.

The consumer plays an important role in the UK economy as household consumption accounts for more than 60% of UK GDP. The MPC therefore faces a dilemma; if they raise rates too soon or too fast they risk derailing an already fragile UK economy, which is already facing uncertainty owing to the ongoing EU exit negations. There was however, a glimmer of hope for consumers this week as UK average weekly earnings reportedly rose on average 2.8% in the three months prior to February, and so if inflation and wages remain at current levels, pressure on consumers could subside.

US earnings season is well underway and next week sees a lot of companies updating investors, of particular interest will be reports from US technology companies which have been the cause of a lot of market volatility lately. Also closely watched next week will be European Central Bank monetary policy announcements and first quarter GDP releases in the UK and US.

Peter Quayle, Investment Management Expert*

*Peter Quayle is a Fund Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.