Week ending 2nd March 2018.

5th March 2018

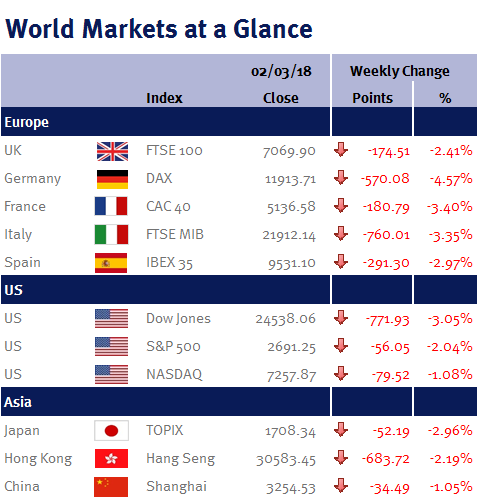

Despite starting the week on a firmer note, all the major equity markets ended the week in the red after Donald Trump’s imposed import tariffs on steel and aluminium.

Even though markets ended the week heavily down, it wasn’t all doom and gloom. Jay Powell made his first appearance as Fed chairman on Tuesday (27 February 2018) and Thursday (1 March 2018) and emphasised continuity as he signalled that the Fed is likely to continue with its gradual interest rate increases. He also made it clear that he doesn’t see any signs of the US economy overheating – in fact, it was announced separately that the US economy expanded at a 2.5% annualised pace in Q4 2017 – below the initial GDP estimate of 2.6%.

While he has previously stated that the market is too fixated on the precise timing of policy moves, he hinted that a March increase was a near-certainty. In view of February’s indiscriminate equity market sell-off (which was based on a return to high inflation and more aggressive monetary tightening), his testimony was very reassuring.

Refreshingly, on inflation, Jay Powell acknowledged (unlike his predecessor, Janet Yellen) that inflation has been low due to persistent factors including technology (the Amazon effect) and globalisation, rather than just one-time transitory factors. And yesterday (Thursday 1 March 2018) the Fed’s preferred inflation gauge, the PCE, was released: PCE for January was unchanged at 1.7%, while the core rate was 1.5% (also unchanged). This compares to 2.0% and 1.9% respectively for January 2017.

Elsewhere, Mario Draghi, the ECB President, was also dovish during his testimony at the EU Parliament, stating that while the eurozone was expanding, inflation has yet to show any sustained upward trend and as a result, the eurozone’s inflation path was still conditional on ECB stimulus.

This Sunday (4 March 2018) is a big day for European politics as Italy goes to the polls, while in Germany, the Social Democrats vote to approve a renewed coalition with Angela Merkel’s CDU.

Elsewhere, next week we have the Fed’s Beige Book; US employment data (non-farm payrolls; unemployment rate; the participation rate; and average earnings); and an ECB monetary policy meeting.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.