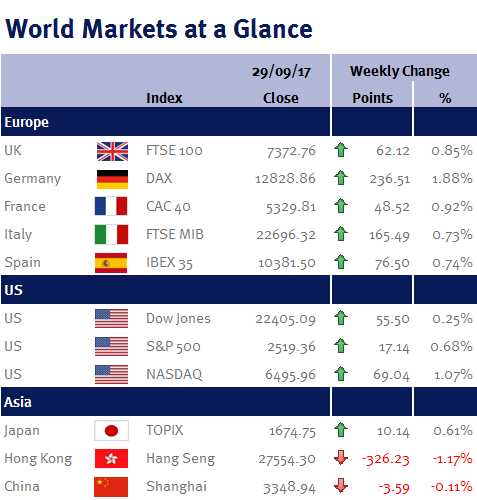

Week ending 29th September 2017.

2nd October 2017

In last Sunday’s (24 September 2017) German elections, Angela Merkel won her fourth term as Chancellor. However, her victory was tainted and her power weakened after she didn’t fare as well as expected as the populist far-right Alternative for Germany (AfD) party gained 13% of the vote, to become the third-largest party in the Bundestag. As a result, she now has the tricky task of negotiating a more complex three-party coalition – a move that will potentially slow (or stop) her plans for closer European integration.

Today (Friday 29 September 2017) we saw a further deterioration in US inflation data. The core PCE, the Fed’s preferred inflation measure, fell to 1.3% – the lowest level since Q4 2015. While Janet Yellen this week (Tuesday 26 September 2017) reiterated that it was imprudent to keep monetary policy on hold until inflation reaches 2% and that the Fed should be “wary of moving too gradually”, several other policymakers this week expressed their doubts. For example, Neel Kashkari, the Minneapolis Fed President and Chicago’s Charles Evans, both said tightening before seeing clear signs inflation would be a mistake.

Unless the Spanish government can stop it, on Sunday (1 October 2017), Catalonia (which accounts for around a fifth of the Spanish economy) will hold an independence referendum. Although the vote has been ruled illegal, the government’s approach may spur separatist sentiment and put the euro under pressure.

Minutes from the last ECB monetary policy meeting are the economic highlight of this week coming, along with US employment data (non-farm payrolls; unemployment rate; the participation rate; and average earnings).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.