Week ending 18th August 2017.

21st August 2017

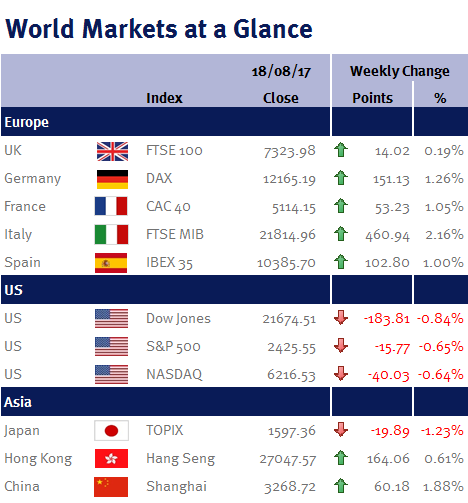

Global equities ended the week higher amid an easing of tensions between the US and North Korea.

Minutes show some US Fed members are questioning whether they need to continue raising interest rates (having already done so twice this year), as US inflation continues to lag the Fed’s 2% target (and has done so now for over 5 years). However, some policymakers believe that a delay could lead to an inflation overshoot. Policymakers were also split on the timing of its planned balance sheet reduction (reversing quantitative easing) with some members prepared to begin immediately whilst most wanted to defer the decision until the September meeting.

UK retail sales rose more than forecast in July; however this was largely driven by food purchases at supermarkets, as most other sectors saw declines. UK inflation was very slightly lower than market consensus but still resulted in a slide in the value in the pound, as the miss was attributed to lower fuel costs. Finally in the UK, second quarter unemployment came in at 4.4%, the lowest level since 1975.

Japan saw its sixth consecutive quarter of expansion in the second quarter of 2017, largely driven by strong domestic demand, although declining exports and rising imports held back GDP, it still managed to beat estimates. An improving economy may help Prime Minister Abe’s declining approval ratings and also help Japan’s Central Bank justify maintaining its massive quantitative easing programme, especially as we begin to see signs of inflation.

Following the recent focus on geopolitical events, this coming week’s attention will shift back to the world’s major central banks, as both Janet Yellen (Governor of the Federal Reserve) and Mario Draghi (President of the ECB) will be speaking at the annual Jackson Hole meeting.

Peter Quayle, Investment Management Expert*

*Peter Quayle is a Fund Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.