Week ending 4th August 2017.

7th August 2017

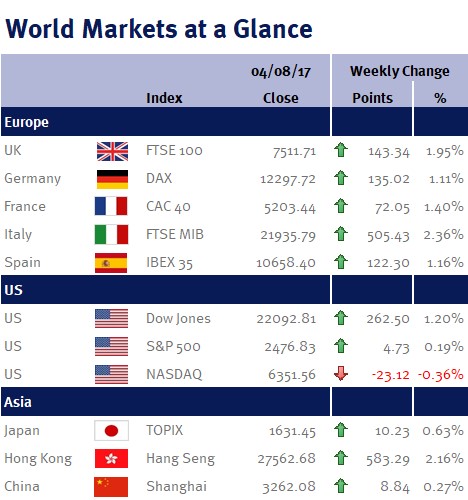

Markets broadly ended the week higher in the wake of a relatively muted week for global politics. After the sacking of James Comey earlier in the year following a probe into Donald Trump’s alleged collusion with Russia to influence last year’s US presidential elections, Christopher Wray was sworn in on Wednesday (2nd August) as the new Director of the FBI. This appointment added an air of stability in an otherwise uncertain US political backdrop, with Wray formally serving as a Federal Prosecutor and head of the Department of Justice’s Criminal Division.

At the corporate level the global technology sector has been influential in steering markets over the past few weeks with many of the big names reporting. This week was the turn of Apple seeing their third-quarter revenues rising 7.2% to $45.4 billion compared with the average projection of $44.9 billion. They signalled that their product demand is strong, with iPhone demand in particular remaining resilient, resulting in them increasing their revenue forecast. This aids in buoying confidence in the sector following a selloff and also drove the S&P500 to its highest level, and saw the Dow Jones break through 22,000 on Wednesday (2nd August) for the first time in history.

With the US in mind, one of the key data sets last week was that of US employment, used by the Federal Reserve (Fed) as a gauge of both policy effectiveness and indeed policy change. July headline unemployment dropped to 4.3%, but despite this the wider market is considering a September rate hike unlikely. With employment data continuing to be strong, and wage growth still lagging long term requirements it introduces a new dynamic for the Fed to address. As strong employment data should increase wages which should put pressure on inflation, yet this relationship appears to be detached at present leaving the Fed looking for ways of re-establishing it.

Jonathan Wiseman, Investment Management Expert*

*Jonathan Wiseman is a Chartered Wealth Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.