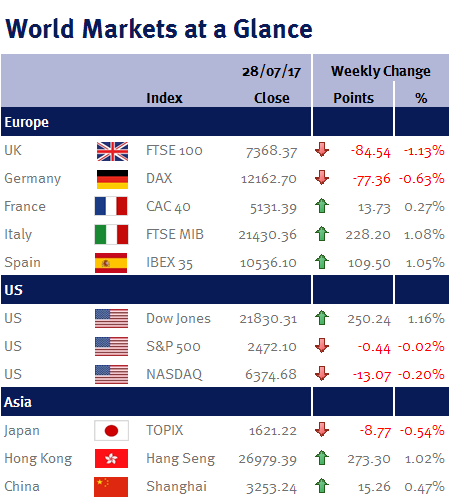

Week ending 28th July 2017.

31st July 2017

This week all eyes were on the US Fed’s monetary policy meeting (25-26 July 2017).

As expected US interest rates were left unchanged. However, there were a couple of subtle nuances in the language of the accompanying statement, which I believe are noteworthy as it made the tone slightly dovish.

The other was on the timing of their planned balance sheet reduction (reversing QE – which I believe is a potential substitute for short-term interest rate increases). This was changed to ‘relatively soon’ from ‘soon’. Whilst this may still seem very ambiguous, it suggests to me that the Fed is considering starting in September (which if correct would significantly reduce the odds of another US interest rate increase this year).

The UK’s 2Q GDP came in as forecast at 0.3% on Wednesday (26 July 2017). However, the Office for National Statistics said the UK economy experienced a “notable slowdown in the first half of this year” – and it is this lacklustre growth that reinforces my expectations of lower-for-longer interest rates in the UK. While today’s (Friday 28 July) US 2Q GDP came in just below expectations at an annualised rate of 2.6% (up from Q1’s 1.2% pace), business investment was up by the most in almost two years – signalling that the eight-year economic expansion can be sustained.

For this coming week, the Fed’s preferred measure of inflation (the PCE) and non-farm payroll data will be of interest after this week’s slightly dovish statement from the Fed.

In the UK, 3 August 2017 is ‘Super Thursday’! This is one of the Bank of England’s (BoE) four big policy days in the year when we get: the BoE’s interest-rate decision (while I expect interest rates will be unchanged, the level of dissent will be the main focus); the quarterly growth and inflation report is published; and Mark Carney, the BoE Governor, holds a press conference.

Other notable data includes eurozone unemployment, CPI and 2Q GDP.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.