Week ending 12th May 2017.

15th May 2017

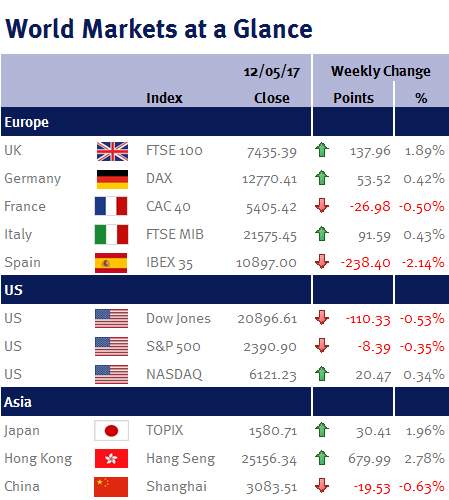

The markets ended the week with a backdrop that echoed an air of stability off the back of some positive political events and economic data sets.

The French election result that saw Francois Macron’s pro Europe Centrist Party defeat the far right party of Marine Le Pen was not only beneficial for the stability of the French economy, but was also a further defeat of an extremist populist party within Europe. This victory is further evidence that the broader populations of European countries continue to support the EU and Eurozone. The victory has also partially reintroduced investor faith back into polling data, with the polls accurately depicting the primary and secondary rounds. This faith could prove to be a key factor for the rest of 2017, aiding in reducing market volatility with both the UK and German elections still to come.

Friday saw the release of US inflation data with the broadest inflation gauge CPI (consumer price index) measuring 0.2% for April 2017, and 2.2% year on year. This came in slightly lower than expectations following a slowdown in energy, transport and healthcare, but is still seemingly higher than the US Federal Reserve Bank’s 2% inflation target, seeing the broader US market stabilise after the euphoria following the election of Donald Trump.

Jonathan Wiseman, Investment Management Expert*

*Jonathan Wiseman is a Chartered Wealth Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.