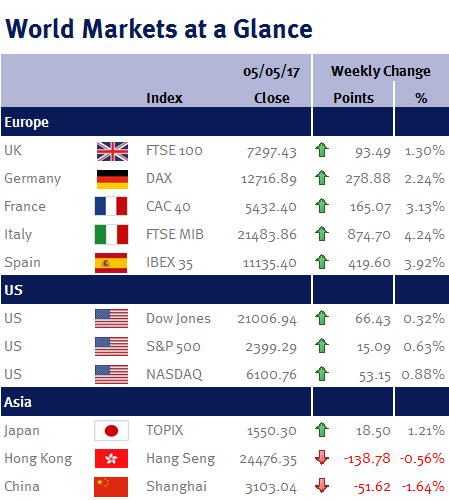

Week ending 5th May 2017.

8th May 2017

As expected the Fed left US interest rates unchanged. However, the accompanying statement was more hawkish than expected.

While acknowledging that US economic data had slowed during Q1, the policymakers stated that they view the recent slowdown as “transitory” and not significant. Consequently, it would appear that they haven’t changed their view that the US economy can handle a gradual increase in interest rates.

And to be fair, today’s (Friday 5 May 2017) US employment data was fairly positive, with 211,000 jobs created in April (compared with just 79,000 in March). As a result, the unemployment rate fell to 4.4% – its lowest since May 2007. However, average hourly earnings remained muted, increasing by a less-than-expected 2.5%.

Therefore, a June interest rate increase is still a possibility.

Annoyingly, there was no word from the Fed on balance sheet reduction, even though it is highly likely this would have been a big focus during their monetary policy meeting, following last month’s minutes which highlighted outline plans. Consequently, we will have to wait for the meeting’s minutes for further details (due to be announced on Wednesday 24 May 2017).

The week’s other big story was oil: Brent oil traded below $49 for the first time since last November on realisation that OPEC’s production cuts weren’t reducing global stockpiles, as US shale production has filled the gap (I have long argued that shale was a game changer and has replaced OPEC as the price setter). And as an aside, while I am over-simplifying it, global inflation will not sustainably rise while core inputs (such as oil) are falling – again suggesting that the Fed’s dot-plot (see above) could be unrealistic.

This weekend coming (Sunday 7 May 2017), France will choose its new President. Opinion polls (which were very accurate for the first round) currently point towards the centrist Emmanuel Macron beating far-right Marine Le Pen by a very wide margin – and as polls close at 7pm UK time, we should have a good idea of the result well before bedtime. However, as financial markets are already convinced of (and priced in) an Emmanuel Macron victory, don’t expect a repeat of the relief rally seen following the first round election on Monday 24 April 2017.

We also have the Chinese FX reserves (Sunday 7 May 2017) and trade balance (Monday 8 May 2017) and on Wednesday (10 May 2017) Mario Draghi, the President of the ECB, will explain his monetary policies to the Dutch parliament.

Then on Thursday (11 May 2017) the Bank of England will issue its monetary policy decision and meeting minutes, alongside its quarterly inflation report and press conference given by the Governor of the Bank of England, Mark Carney.

The following day (Friday 12 May 2017) we have US CPI, retail sales and the University of Michigan consumer sentiment index.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.