Week ending 14th April 2017.

18th April 2017

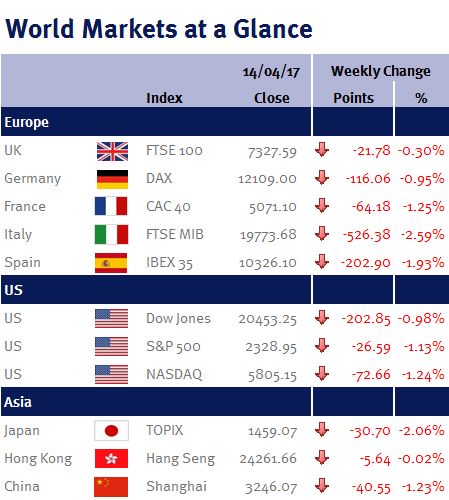

Geopolitics continued to dominate headlines this week leading to declines in global equity markets.

Tensions with North Korea were running high and aggravated by the US decision to deploy an aircraft carrier and accompanying warships to waters off the coast of the North Korean Peninsula.

Following recent events in Syria, US Secretary of State Rex Tillerson visited Moscow on Wednesday (12 April 2017) and whilst unable to agree on the facts surrounding the chemical attack, the two nations did agree to establish a working group to address smaller issues and make progress towards stabilizing the relationship.

Inflation on the other side of the Atlantic was a slightly different story, against forecasts for no change, data released on Friday when the markets were closed, unexpectedly showed US inflation declined 0.3% in March. Motor vehicles, wireless phones services and apparel were to blame for the decline. Whilst one reading should not be cause for concern, all eyes will be on next month’s report.

This weekend Turkish citizens head to the polls to vote on a referendum which could see the consolidation of power to a centrally executive president rather than the current parliamentary system. On Monday (17 April 2017) China releases gross domestic product figures for the first three months of 2017. On Tuesday the International Monetary Fund releases its World Economic Outlook ahead of its spring meeting with the World Bank commencing on Friday. Other notable data releases throughout the week include US industrial production (Tuesday), Eurozone inflation (Wednesday), UK retail sales, Eurozone and US PMIs (Friday).

Peter Quayle, Fund Manager

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.