Week ending 31st March 2017.

3rd April 2017

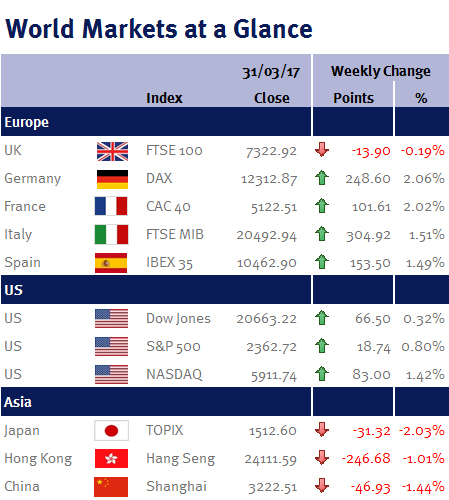

Last week’s sell-off in global equity markets sparked by the decision to cancel the vote on Donald Trump’s healthcare bill reversed this week with most global equity markets resuming their upward trajectories as investors instead focused on the prospects for Donald Trump’s pro-growth policies.

While cracks have appeared in the so-called ‘Trump Trade’, there are no signs that the economic growth that’s underpinned the recent rally is faltering – for example this week (Tuesday 28 March 2017) we saw US consumer confidence jump to 125.6 from 116.1 in February, its highest reading in just over 16 years.

On Wednesday (29 March 2017), 9 months after the EU Referendum the UK finally invoked Article 50. Confidence is high that a Brexit deal will be reached by October 2018. However, Theresa May’s 6 page letter to Donald Tusk, the EU President, highlighted the complex and contentious negotiations ahead which will demand considerable horse trading and arm twisting before the UK’s new relationship with the EU can be redefined. Elections in France (May 2017) and Germany (September 2017) could also serve as a distraction and delay the UK’s deal. However, everyone knew this day was coming, and as such the FTSE-100 and the pound were little changed on the day.

It is a busier week ahead for economic data. Highlights include the Japanese Tankan report, eurozone retail sales, Fed minutes and US unemployment. Additionally Donald Trump meets Xi Jinping, the Chinese President, in Palm Beach.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.