Week ending 24th February 2017.

27th February 2017

‘Fairly soon’ was the message from the minutes of the last US Federal Reserve (Fed) monetary policy meeting, as policymakers suggested an interest rate increase may be appropriate to avoid the US economy overheating.

However, the ‘fairly soon’ reference was tempered by the fact that the policymakers are confident that interest rates only need to increase gradually as there is currently very little risk that inflation will suddenly accelerate.

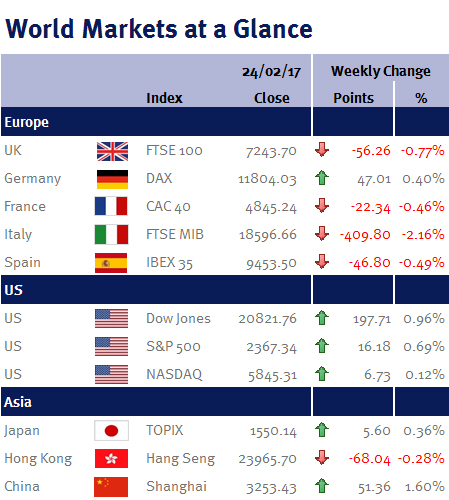

While the Dow Jones was busy recording its 11th straight new closing high in anticipation that Donald Trump will cut taxes, ease regulation and announce a major infrastructure spending program, European equities retreated towards the end of the week as politics returned to the fore.

The first round of France’s election takes place on Sunday 23 April and polls currently suggest that Marine Le Pen’s right-wing, anti-euro, National Front party could come out on top. While none of the poll have so far have shown Marine Le Pen even close to a victory in May’s second, and final round (on Sunday 7 May), recent polls have shown that she has narrowed the gap.

Elsewhere polls in Germany suggest that Angela Merkel’s ruling party has fallen behind the Social Democrats (German elections are on Sunday 24 September 2017), while Matteo Renzi resigned as leader of Italy’s Democratic Party.

Economic highlights this week include: Japanese & eurozone CPI; Chinese & UK PMIs; preliminary US & French Q4 GDP; US durable goods orders; US pending home sales; US PCE. We also have a number of Fed officials speaking.

However, as mentioned above, all attention will this week be focused on Donald Trump’s major congressional address on Tuesday (28 February).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.