Week ending 17th February 2017.

20th February 2017

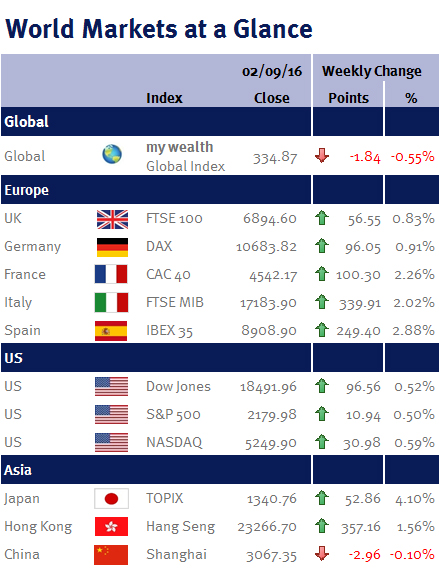

Global equities continued their advance, with US markets climbing to record levels, thanks to generally strong economic data coupled with last week’s teaser from Donald Trump regarding his “phenomenal” tax plans.

The US Federal Reserve (Fed) Chair Janet Yellen said more interest-rate increases may be appropriate as the economy closes in on the central bank’s goals for maximum employment and 2% inflation. Despite her more hawkish sounding comments, she gave no indication of the timing of the next interest rate increase in her prepared semi-annual statement on monetary policy to Congress.

The economic week ahead brings the minutes of the last Fed Federal Open Market Committee meeting, which may signal members’ views on President Donald Trump’s policies and their economic impact. We also have a number of PMI surveys; US housing market data; US jobless claims; eurozone CPI; and the second estimate of UK Q4 GDP. Additionally, Mark Carney, the BoE Governor, testifies before the UK Parliament’s Treasury Committee, while eurozone finance ministers discuss Greece’s stalled bailout.

US markets are closed Monday (20 February) for a public holiday (Presidents’ Day/Washington’s Birthday).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.