Week ending 10th February 2017.

13th February 2017

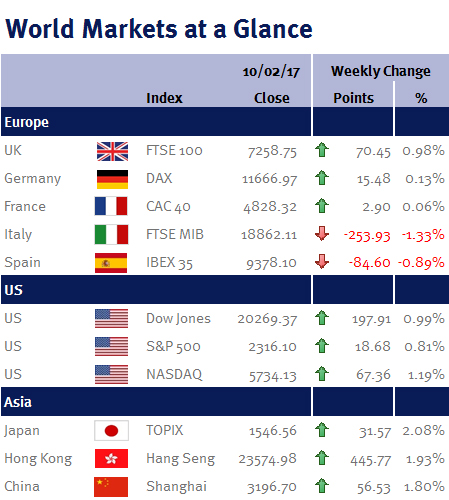

It was another week that was all about Donald Trump: while media headlines concentrated on his immigration ban and its setback in the appeals court, global equities were busy climbing higher after he promised that details of a “phenomenal” tax plan would be announced in the next few weeks.

Elsewhere, the yield on Greece’s 2-year debt rose to 10% due to an impasse between creditors ahead of a deadline to receive further bailout funds, while the UK’s housing white paper revealed very little new.

It is a busy week ahead for economic data. In the UK we have CPI, unemployment and retail sales data. In Europe we have eurozone Q4 GDP and the publication of minutes from the ECB’s last monetary policy meeting. In the US, we have inflation figures for January; while Janet Yellen, the Federal Reserve Bank Chair, spends two days delivering her semi-annual Monetary Policy Report to Congress (listen out for hints on the timing of the next US interest rate increase and comments on the value of the US dollar).

And Donald Trump: he hosts Justin Trudeau, the Canadian Prime Minster and Benjamin Netanyahu, the Israeli Prime Minster – so the media will be watching for an international incident or two, as trade could be an issue after Donald Trump said he plans to renegotiate the North American Free Trade Agreement.

Ian Copelin, Investment Director

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.