Week ending 3rd February 2017.

6th February 2017

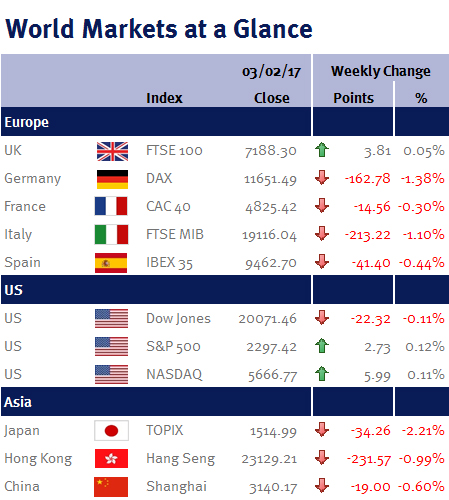

While the news headlines were dominated by Parliament’s vote on Brexit and Donald Trump’s executive orders and his sacking of the acting US attorney general, Sally Yates, markets were more concerned with economic news.

Attention was also on US corporate earnings. We are now just over halfway through this quarters reporting season: of the 274 S&P 500 companies that have reported, 204 companies (74.45%) reported earnings above estimates and in aggregate, companies reported earnings 3.3% above expectations (Telecommunications have so far been the main disappointment).

In the UK, the Bank of England’s (BoE) Monetary Policy Committee left interest rates unchanged at 0.25% and gave no indication on the direction of its next move. While the BoE increased its growth forecast to 2% for 2017 (up from its earlier forecast of 1.4%) and expects inflation to overshoot its 2% target for the next 3 years (peaking at 2.8% early next year), they warned that there is still slack in the economy and uncertainty over how the UK economy will adapt to Brexit negotiations as business investment has already flat-lined.

Although the week ahead is quieter on the economic front (we have China’s foreign exchange reserves on Tuesday (7 February) and its trade balance on Wednesday), in the UK we have the housing white paper – due to be published on Tuesday (7 February). Over recent years house builders have enjoyed super-normal trading and profitability. However, leaks and recent media speculation suggests that going forward growth may be slower.

Ian Copelin, Investment Director

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.