Week ending 27th January 2017.

30th January 2017

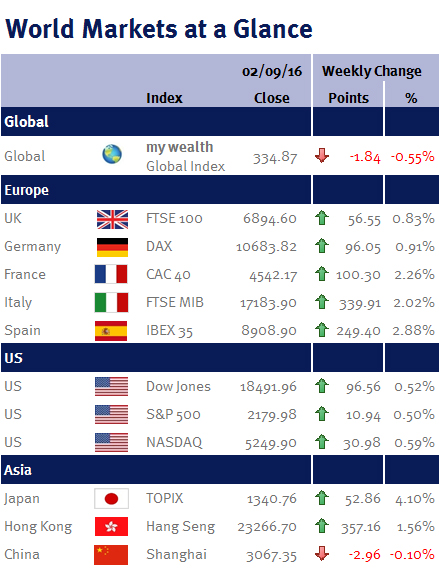

Most global equity markets nudged higher over the week led by gains in US equites, with the three main indices (see table) reaching all-time highs.

US economic growth slowed to an annualised pace of 1.9% in Q4 (matching the US Federal Reserve Bank’s (Fed) growth target), while the UK economy continued to show resilience by maintaining its strong performance since the Brexit vote last June by expanding faster than expected at 0.6% in Q4. This means that the UK economy expanded by 2% during the year.

However, the UK’s growth was predominately driven by services and consumer spending, which may prove to be unsustainable if household purchasing power gets squeezed by this year’s expected pickup in inflation (sterling has dropped over 15% against the US$ and 10% against the euro since the referendum which pushes up the cost of imports).

In fact, over the week a number of companies including Whitbread (owner of Premier Inn, Costa Coffee and a number of restaurant chains including Beefeater and Brewers Fayre), BT Group and EasyJet all warned of Brexit-linked problems and the potential impact of accelerating inflation on consumers this year.

Looking ahead, we have a number of central bank announcements on monetary policy: The Bank of Japan; the Bank of England (interest-rates are likely to remain unchanged at 0.25%); and the US Fed (after increasing rates in December, the Fed is likely to leave rates unchanged, especially given recent comments by Janet Yellen, the Fed chair). The Bank of England will also publish its quarterly Inflation Report (which sets out its economic analysis and inflation projections).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.