Week ending 6th January 2017.

9th January 2017

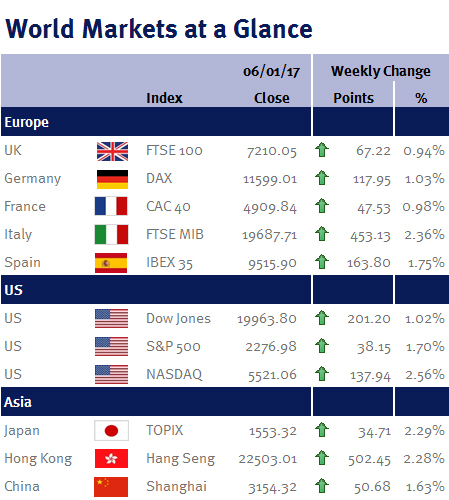

Global equity markets moved higher over the week. And this upward move, coupled with renewed sterling weakness, helped to lift the FTSE-100 to its seventh straight record closing high and its ninth consecutive daily advance (sterling weakness helps exporters and multinational companies as over two-thirds of the FTSE-100’s total revenue is derived from abroad).

China’s yuan strengthened on Friday on speculation that Chinese authorities were preparing contingency plans to support their currency and curb capital outflows.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.