Week Ending 23rd December 2016.

30th December 2016

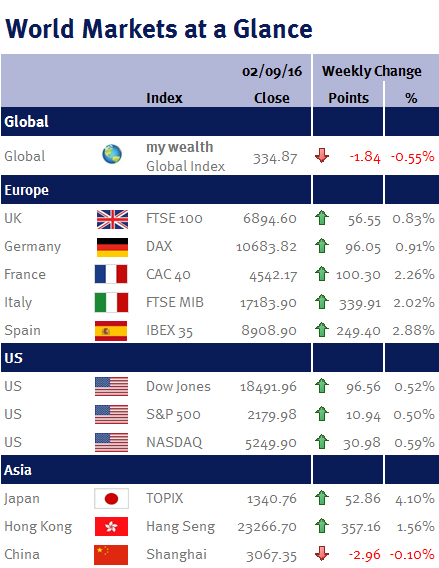

In light trading volumes ahead of the Christmas break most equity markets ended the week with small gains.

US GDP growth for the third quarter was revised upwards from an annualised growth rate of 3.2% to 3.5% – lifting the year-on-year growth rate to 1.7% – helped by stronger consumer spending, business investment and government purchases. Although this growth rate is unsustainable (forecasts for the fourth quarter are currently for annualised growth of 2.2% as the third quarter was helped by a large surge in agricultural exports), the revisions show the US economy is growing sufficiently to justify the recent US interest rate increase.

Likewise the UK’s third quarter GDP growth was also revised upwards, from 0.5% quarter-on-quarter to 0.6%.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.