Week ending 16th December 2016.

19th December 2016

The past week was dominated by the US Federal Reserve Bank’s (Fed) decision to increase US interest rates by 25 basis points to a range of 0.50-0.75% from 0.25-0.50%.

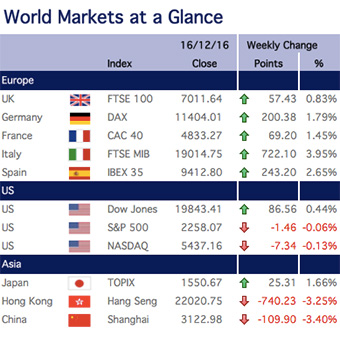

While the move was widely anticipated given recent comments from a number of Fed officials, coupled with the strengthening US employment market, it was clearly the case of the old saying “buy the rumour, sell the news”, as US markets continued their recent strong run ahead of the announcement by registering another record high on Tuesday 13 December, only to retreat afterwards.

The Fed’s accompanying statement suggested that the pace of tightening was likely to accelerate, with three increases in 2017, up from 2 indicated previously.

As a result of the retreat, the Dow Jones failed to break through the psychological level of 20,000 – having been within 34 points of it during trading on Wednesday. However, to put this in context, the Dow Jones only broke through 19,000 for the first time on Tuesday 22 November – just 3½ weeks ago!

Elsewhere, the Bank of England left UK interest rates unchanged at 0.25% during their rate-setting meeting. While the committee acknowledged that the UK economy had performed much better than expected since the EU Referendum on 23 June, they reiterated that growth in 2017 was likely to slow.

Ian Copelin, Investment Director

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.