Week ending 9th December 2016.

12th December 2016

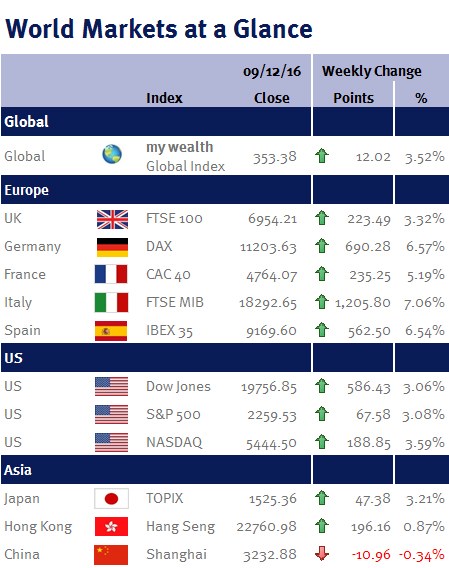

European markets brushed aside news that the Italian Prime Minister, Matteo Renzi, was resigning after losing the referendum that would have allowed him to push through constitutional changes as a ‘No’ vote (and his resignation) was already priced into the market. European equity markets were subsequently helped by the European Central Bank’s (ECB) decision to extend its QE program by 9 months to the end of 2017.

Although the ECB’s monthly asset purchases (QE) will be reduced from €80bn to €60bn, Mario Draghi, the ECB President, signalled he would add to stimulus if the eurozone economy didn’t improve (while the economy has been showing signs of improvement in recent months, German industrial production disappointed by rising less than forecast in October, while euro-area inflation at 0.6% hasn’t been anywhere near the ECB’s 2% target since January 2013).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.