Week ending 2nd December 2016.

5th December 2016

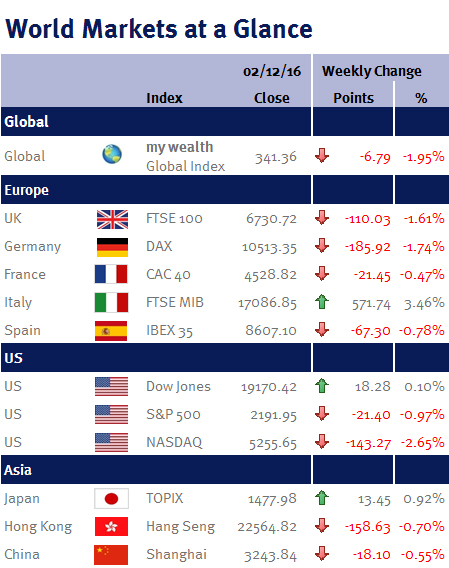

Most global equity markets (with the exception of Italy) ended the week lower ahead of this Sunday’s (4 December) Italian constitutional referendum. The Italian Prime Minister, Matteo Renzi, has said that he will resign if the public vote ‘No’, which polls currently suggest will happen.

In the US, the Federal Reserve’s (Fed) ‘Beige Book’ (a summary of information and commentary on regional economic conditions), suggested that the US economy continued to expand across most of the country, with seven of the central bank’s 12 districts reporting moderate or modest growth over the period October to Mid-November – although some districts reported some uncertainty in the wake of the Presidential election. The Fed also said that while there was little inflationary pressure, there was tightness in the labour market, with a shortage of workers in a number of districts including Cleveland and San Francisco.

The Beige Book coupled with this week’s US payroll data bakes-in an increase in US interest rates at the next Fed monetary policy meeting on 13-14 December. However, while the odds that the Fed will increase interest rates by 25 basis points (to a range of 0.50%-0.75% from a range of 0.25%-0.50%) are fully factored into equity prices, the outlook for further increases in 2017 is in doubt after US wages unexpectedly declined. The US economy added 178,000 non farm jobs in November, pushing the unemployment rate down to 4.6%, while hourly wages declined by 0.1% (economists had expected earnings to rise 0.2%).

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.