Week ending 25th November 2016.

28th November 2016

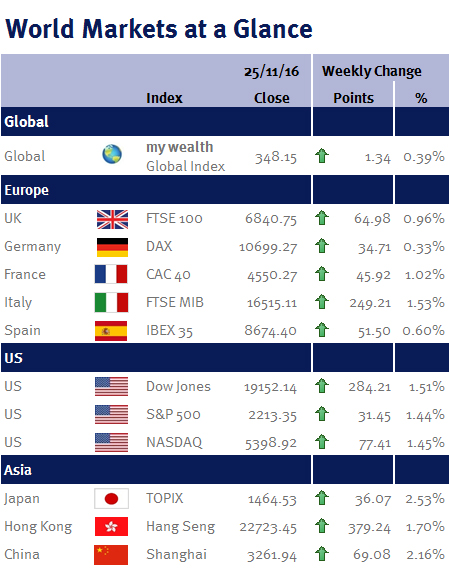

The broader global equity markets ended the week on a high, fuelling further expectation that a Trump presidency could indeed prove positive for Global markets. We have already begun to see signs of the US President-elect softening his stance on many of his campaign trail claims, such as Obamacare (the US healthcare system), accepting that he would not be scrapping the provision all together as initially anticipated.

Last week saw the UK Chancellor Phillip Hammond announce the Autumn Statement, one which sparked little controversy in terms of policy introduction. The statement, for global stock markets at least, was uneventful. A similar market impact was echoed by the US Federal Reserve Bank when they released the minutes of their last meeting, giving little more by way of clarity or guidance on a potential interest rate rise.

In other regions we saw a stronger than expected set of consumer confidence data coming from Europe, which in the wake of the UK ‘Brexit’ referendum suggests consumers are not fazed by the prospect of life ‘without’ the UK. This is supported by the strong PMI (purchasing manager index) data, a measure which gauges the health of the manufacturing sector.

Outside of the regions, broader expectation of a deal between the major oil producing nations pushed oil prices higher on Monday (Brent Crude closing at $48.9 per barrel, from the previous close of $46.86). Failure to reach an agreement caused a pull back in oil, still ending the week higher at $47.24 per barrel ahead of this week’s meeting of OPEC, the Organisation of Petroleum Exporting Countries.

Jonathan Wiseman, Investment Management Expert*

*Jonathan Wiseman is a Chartered Wealth Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.