Week ending 28th October 2016.

31st October 2016

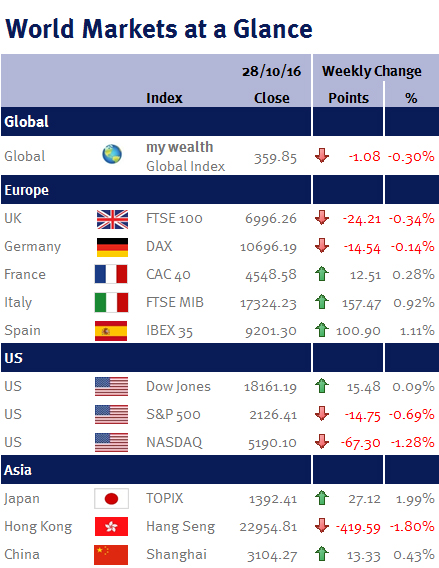

Most global equity markets ended the week slightly lower as expectations for higher interest rates strengthened.

Third-quarter US economic growth was the fastest in two years, growing at an annualised rate of 2.9%, up from a 1.4% gain during the second-quarter and well ahead of the expected 2.6% growth.

Meanwhile the UK economy expanded by 0.5% during the third-quarter. Although this was slightly slower than the 0.7% GDP growth recorded in the second-quarter, it beat expectations of 0.3% and defied most of the pre-Brexit vote predictions. For example, the Treasury forecast that the UK economy would contract by between 0.1% and 1% during the quarter if the UK voted to “Leave” – although in their defence, it assumed that Article 50 would be triggered immediately and didn’t take into account the subsequent and extensive stimulus measures from the Bank of England (BoE).

The GDP announcement coupled with the news that Nissan would build two new car models in Sunderland and AXA’s property division would proceed with its plan to build London’s tallest skyscraper helped the pound to rally as it suggests Brexit has, so far, had little effect and makes it less likely that the BoE will provide further stimulus in the short-term.

However, this proved short-lived and sterling ended the week 1.21% weaker against the euro and 0.62% weaker against the US dollar, while the benchmark 10-year gilt yield increased just over 17 basis points to yield 1.258% – its highest level since the Brexit vote as reports from GfK, YouGov and Asda all cited weaker consumer confidence and household spending power (the consumer accounts for around 60% of the UK economy) as rising inflation is already starting to squeeze household finances.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.