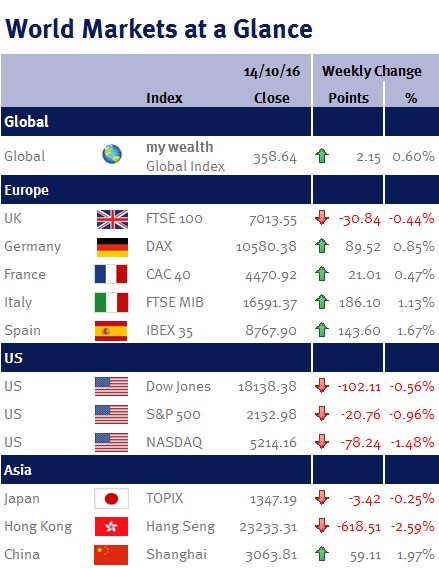

Week ending 14th October 2016.

17th October 2016

The FTSE-100 hit its highest ever level of 7129.83 just after midday on Tuesday (11 October). Unfortunately, the index subsequently retreated and so failed to record a new closing high – the FTSE-100’s all-time closing high of 7103.98 has stood since 27 April 2015.

However, most global markets weakened during the second half of the week following the release of US Federal Reserve (Fed) minutes and Chinese economic data.

Minutes from the last Fed meeting on 20-21 September indicated that while several Fed officials thought third-quarter US GDP growth and employment market gains were balanced by continued below target inflation it may be appropriate to raise rates “relatively soon” and that it was a “close call” whether or not to increase at the September meeting.

However, Janet Yellen, the Fed’s Chair, muddied the picture on Friday by suggesting that running the US economy hot could boost economic growth and labour force participation.

Elsewhere China’s six months of rising exports came to an end, dropping 10% in September – suggesting that global demand remains lacklustre.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.