Week ending 7th October 2016.

10th October 2016

The pound had a bad week. It began by falling to its weakest level versus the euro since 2011 and a 31 year low versus the US dollar of around $1.27, before becoming the latest victim of a flash crash, falling to $1.1752.

Then in a chaotic two minutes of trading in Asia on Friday morning (just after midnight for us), the pound suddenly fell nearly 7%.

Whilst the catalyst isn’t actually known and could simply have a been a trader’s “fat finger” (i.e. a misplaced keystroke) or computer initiated algorithmic trading, it coincided with comments from Francois Hollande, the French President, that EU officials should take a tough negotiating stance with the UK – implying that both sides were currently accepting of a hard Brexit.

While the drop was short-lived (the pound quickly recovered most of the flash crash losses during the following hour), it still ended the week 3.93% lower at $1.246.

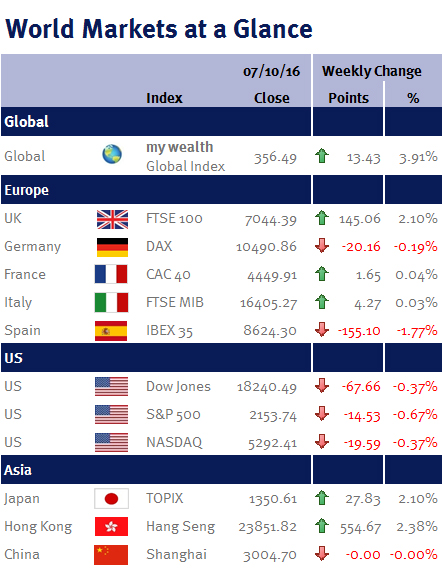

As a result of the weaker pound and a firmer oil price (which rose to $50.33 a barrel) helped to make the FTSE-100 one of the best performing equity markets over the week, rising 2.10% to 7,044.39.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.