Week ending 30th September 2016.

3rd October 2016

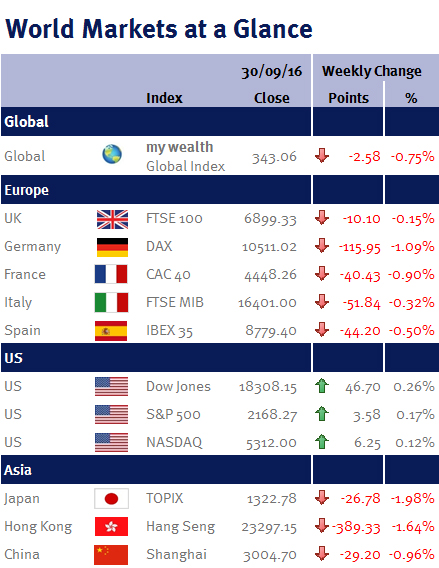

After a volatile week, most equity markets ended the week barely changed.

OPEC (Organisation of Petroleum Exporting Countries) reminded people of its existence when it surprised the market by agreeing that they needed to cut production to help reduce the current global surplus. Whilst very few details were announced, production is expected to be cut by 750,000 barrels per day. Consequently, Brent crude rose to $47.71 from $44.86 a week earlier. This helped shares in BP (which ended the week up 3%) and Royal Dutch Shell (+2.2%).

However, in my opinion, the oil price is unlikely to have a sustainable long-term rally as OPEC quotas have historically been exceeded and if prices did manage to have a sustained rally there is plenty of shale oil waiting to come back online – I have long argued that OPEC can no longer determine the oil price, as the new swing producers are the shale explorers.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.