Week ending 23rd September 2016.

26th September 2016

Another FOMC ‘pass’ comes to pass!

The Federal Open Market Committee (FOMC), the interest rate setting body of the US Federal Reserve (Fed), voted 7-3 to leave interest rates unchanged and said that it would wait for more evidence of progress toward its goals as “near-term risks to the economic outlook appear roughly balanced”.

Interestingly, the three Fed policy makers that dissented in favour of an immediate quarter-point increase won’t be FOMC voting members in 2017.

Consequently, the FOMC may not be so hawkish next year (hawks tend to favour tighter monetary policy, by focusing more on the 2% inflation target, than the Fed’s other goal of full employment) and as a result, I would expect US interest rates to rise at such a slow pace through 2017 and 2018 that the Fed’s ‘monetary tightening cycle’ plan will become effectively irrelevant.

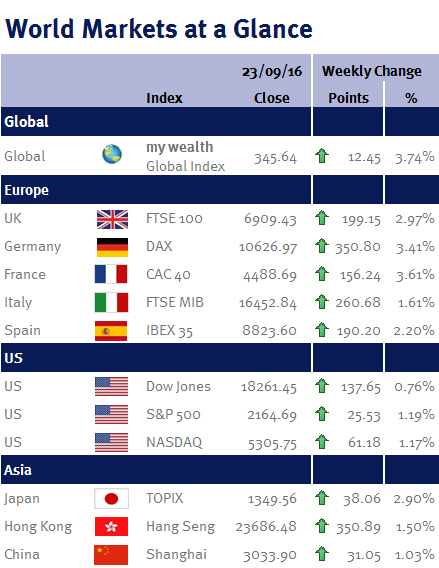

Given the era of central bank accommodation and cheap money is clearly far from over, global equity markets ended the week significantly higher, with the FTSE 100 index closing up 2.97% at 6,909.43, closing in on its 2016 peak of 6,941.19 made on 15 August 2016.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.