Week ending 29th June 2018.

2nd July 2018

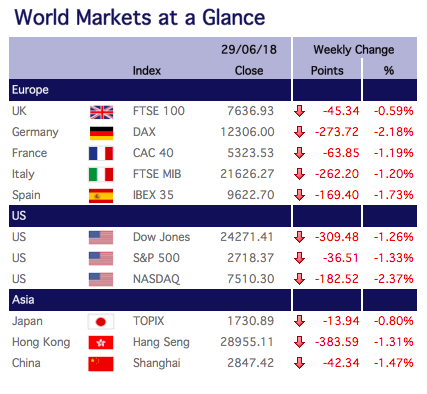

Global trade continued to influence markets this week, and while there were some positive days, equity markets ultimately closed the week lower.

Markets fell on Monday (25th June) following reports the U.S. was preparing to step up pressure on China, by invoking emergency powers using an obscure 1970s law which would have allowed them to block China from acquiring U.S. technology companies and their intellectual property.

Equity markets were relieved by his change of tact, however, his flip flopping is difficult to navigate and Trump appears to be trying to please everyone in the build up to the midterm elections in November.

UK GDP for the first quarter of 2018 was revised up to 0.2% this week increasing the chances of an August rise in U.K. interest rates. The newest member of the MPC (Professor Jonathan Haskel) gave us insight to how he views the U.K. economy this week. Haskel is set to replace hawkish MPC member, Ian McCafferty, in September, and his initial comments suggest he is more dovish, as he suggested there is more slack in the economy and that wage pressures would stay relatively weak.

We begin a new month next week and so most regions will be reporting PMI data. On Sunday presidential elections take place in Mexico, the current front runner, a left wing candidate, has promised to put the poor first and stand up to Donald Trump. On Wednesday the U.S. markets are closed for Independence Day and on Friday the U.S. is scheduled to impose tariffs on $34bn of Chinese goods.

Peter Quayle, Investment Management Expert*

*Peter Quayle is a Fund Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.