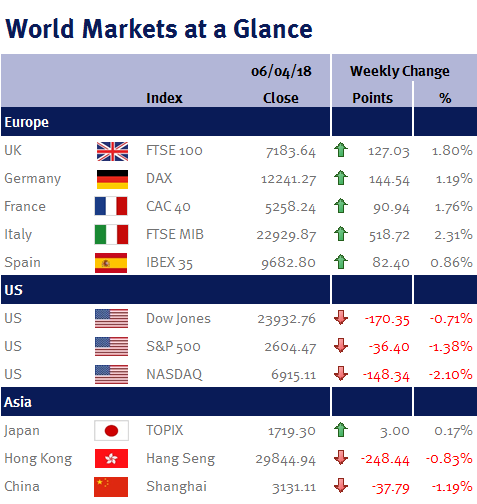

Week ending 6th April 2018.

9th April 2018

It was a quiet week in terms of economic data and company announcements, however, global trade and the technology sector continued to dominate headlines resulting in a volatile week.

Global trade continued to weigh on market sentiment as on Tuesday, the US released details of the 1,333 Chinese goods on which it proposes to levy punitive tariffs. China was quick to respond by saying it would charge 25% tariffs on an additional 106 American goods including politically sensitive soybean exports and some Boeing aircraft. Towards the end of the week, Trump asked his staff to consider tariffs on $100bn of goods, following China saying they will fight to the end.

I am still of the opinion that we are not facing a full blown trade war and recent rhetoric is to address what Donald Trump sees as unfair conditions placed on US companies operating in China and ultimately protect US intellectual property. This sentiment was supported last week as Donald Trump’s chief economic adviser, Larry Kudlow, stressed that this was not a trade war and they were merely trying to protect US businesses. He also highlighted that no new duties have been implemented, and talks with the Chinese will continue for several months before anything is done.

Data released on Friday showed an additional 103k jobs were created in the US in March, which was below expectations with the weather cited as partly to blame for the slowing; this follows an exceptionally strong February which was revised up even further on Friday to 326k. There was a slight pickup in wage growth which has been notably lacking in the recent recovery. Should wage growth be sustained, it would help support the consumer and keep the Federal Reserve on track for further interest rate increases this year.

Next week, Facebook CEO Mark Zuckerberg will testify to Congress following recent revelations of misuse of its users’ data by third parties. The Federal Open Market Committee will release minutes of its March meeting, at which they raised their target interest rate 0.25% and on Wednesday, the US will release inflation data for March.

Peter Quayle, Investment Management Expert*

*Peter Quayle is a Fund Manager at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.