Week ending 9th March 2018.

12th March 2018

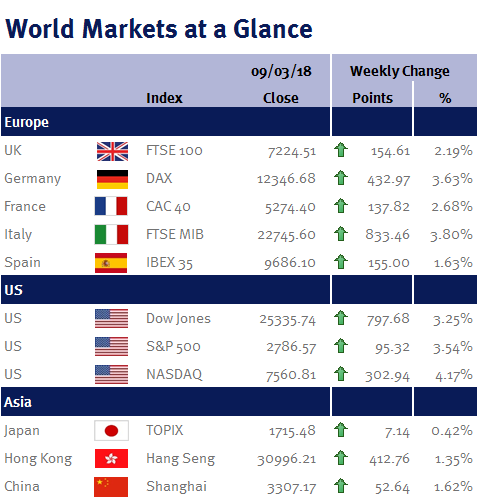

It’s been a pretty good week for equity markets. After last week’s risk-off sentiment following Donald Trump’s import tariffs on steel and aluminium, sentiment swung back to positive on speculation that it won’t spark a trade war as Donald Trump softened his stance (imports from Canada and Mexico are now excluded, while US allies will also be able to apply for exemptions).

Even the resignation of Donald Trump’s chief economic advisor, Gary Cohn (a Democrat), on Tuesday (6 March 2018) in protest to the tariffs failed to significantly panic equity markets; which instead focused on the marked reduction in tensions with North Korea, after Kim Jong-un indicated that he was willing to discuss denuclearisation with the US.

Yesterday (Thursday 8 March 2018) the ECB President, Mario Draghi unexpectedly dropped his pledge to expand the ECB’s monthly bond purchases (QE) if needed. However, while acknowledging the eurozone’s strong economic growth, he said “victory cannot be declared yet” due to subdued inflation. And although he didn’t give any clarity as to when QE will end or when interest rates may start to increase, the tone of his statement didn’t suggest that the eurozone was heading for a higher interest rate environment any time soon.

However, it was today’s (Friday 9 March 2018) US job data that set the market alight. Nonfarm payroll employment rose by 313,000 in February, the most since mid-2016 and well above the median estimate of 205,000, while at the same time wage growth ticked down to 2.6% from 2.8% in January (which itself was revised down from 2.9%). The employment rate was unchanged at 4.1% and the labour force participation rate increased from 62.7% to 63%.

This employment data was very positive: it doesn’t look like the US economy is yet at full employment, while the wage gains that unsettled equity markets last month clearly haven’t taken hold.

Consequently, it appears to me that the goldilocks environment (reasonable economic growth and lacklustre inflation) is still alive and well – and more importantly, it should ease any concerns the market had that there may be four US interest rate increases this year.

This coming week we have Philip Hammond’s first ever Spring Statement; US CPI, PPI and retail sales; and eurozone CPI.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.