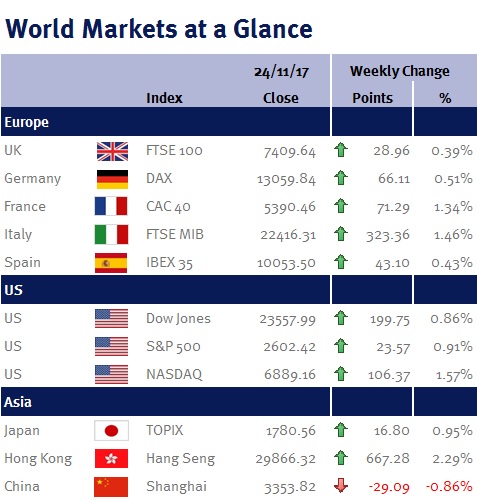

Week ending 24th November 2017.

27th November 2017

While I feel obliged to comment on the breakdown in German coalition talks, in reality it had little impact on equity markets. Even if it takes a few more weeks to reach an agreement, Angela Merkel is likely to be at the centre of the government – and that’s the key for equity markets. Additionally, European’s are more used to living with coalitions than the British. After all, Dutch elections earlier this year resulted in over 200 days of negotiations before a 13-party coalition was formed with a majority of just 1-seat! Additionally, following the Belgium general election in 2010, it took over 500 days of negotiations to form a government.

According to the minutes from the Fed’s meeting on 31 October – 1 November, policymakers were upbeat on economic growth and are ready to raise interest rates “in the near term”. This is a pretty clear signal that US interest rates will be increased during their next meeting on 13 December 2017 despite the fact that US inflation continues to run below their 2% target.

In a separate announcement, it was confirmed that Janet Yellen will leave the Fed once Jerome Powell is sworn in. Additionally, she cautioned that raising US interest rates too quickly risked stranding inflation below the Fed’s target (which if she wasn’t leaving, would suggest to me that she may be finally accepting that inflation expectations are drifting down). Unfortunately, her departure will create a fourth vacancy for Donald Trump to fill, making it trickier to be confident on the Fed’s interest rate trajectory for 2018 and 2019, as several Fed policymakers see the need for ‘normalisation’ to give the Fed some ammunition in the future.

Next week Jerome Powell’s confirmation hearing begins as well as the second print on US Q3 GDP, the Fed’s Beige Book, eurozone unemployment and eurozone CPI.

Ian Copelin, Investment Management Expert*

*Ian Copelin is an Investment Director at Wealth at Work Limited which is a member of the Wealth at Work group of companies

The latest market updates are brought to you by Investment Managers & Analysts at Wealth at Work Limited which is a member of the Wealth at Work group of companies.

Links to websites external to those of Wealth at Work Limited (also referred to here as 'we', 'us', 'our' 'ours') will usually contain some content that is not written by us and over which we have no authority and which we do not endorse. Any hyperlinks or references to third party websites are provided for your convenience only. Therefore please be aware that we do not accept responsibility for the content of any third party site(s) except content that is specifically attributed to us or our employees and where we are the authors of such content. Further, we accept no responsibility for any malicious codes (or their consequences) of external sites. Nor do we endorse any organisation or publication to which we link and make no representations about them.